Alternative fuel

Environmental problem

Internal combustion engines, which drive over 98% of the world’s means of transport, are a significant source of carbon emissions, releasing approximately 8 billion tons of CO2 annually.

This accounts for more than 20% of global CO2 emissions, highlighting the transportation sector’s substantial role in contributing to climate change and the need to decarbonise.

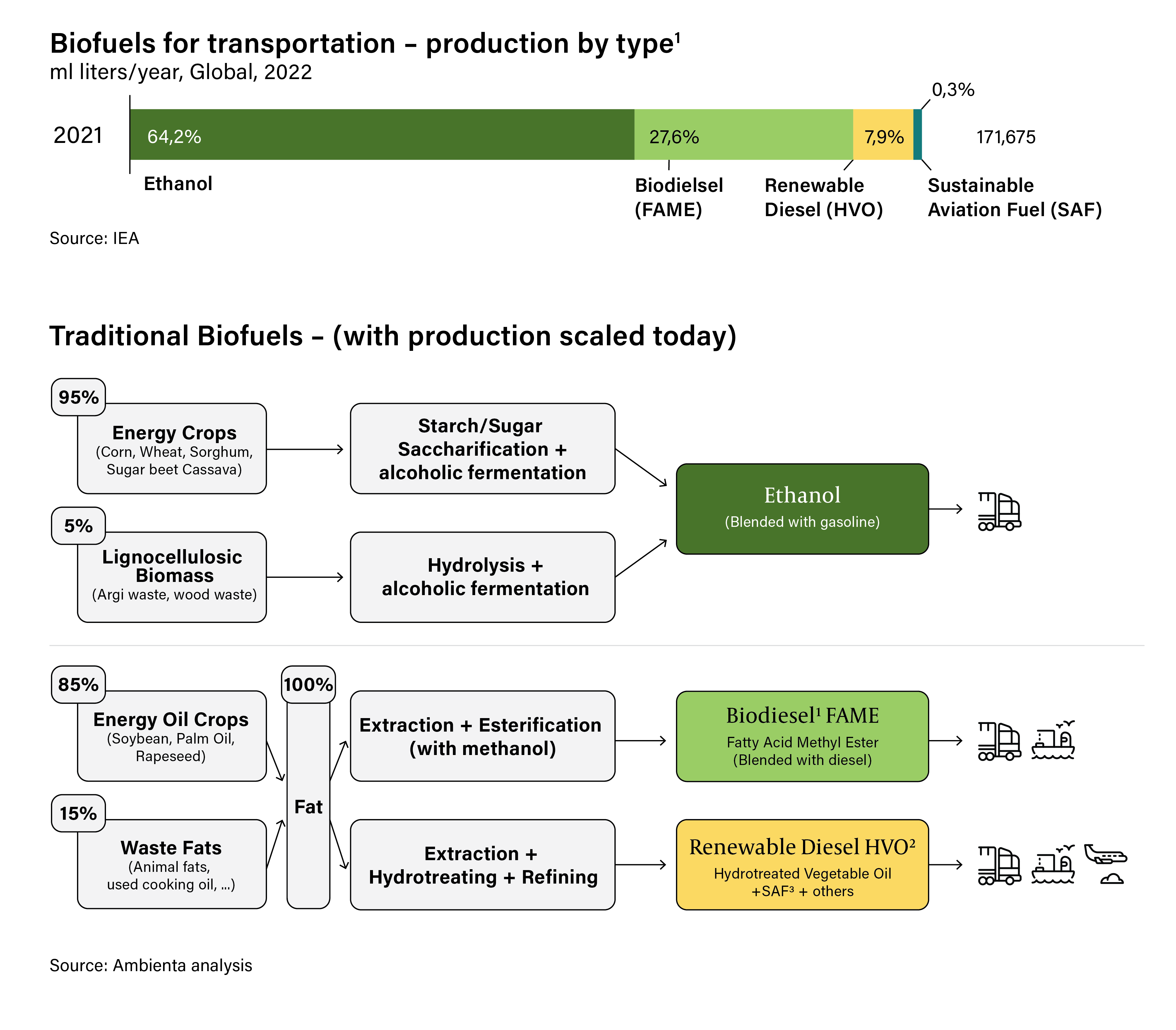

Source: IEA

¹FAME (Fatty Acid Methyl Ester) is biodiesel produced from vegetable oils or animal fats through a chemical process called transesterification.

²HVO (Hydrotreated Vegetable Oil) is renewable diesel produced by hydrotreating vegetable oils or animal fats, resulting in a cleaner-burning fuel.

“Alternative fuels are key to decarbonising transportation, yet 90% of today’s biofuels are unsustainable, produced solely from energy crops.”

The path to decarbonization of the sector differs across transportation modes. While the shift towards electric vehicles is helping reduce emissions from passenger cars, this move alone falls short of addressing the broader carbon footprint challenge the transportation industry faces. For aviation, maritime, and partially long-distance road transportation, directly electrified solutions are not viable in the medium/long term. Thus, the transition to alternative fuels becomes essential for a cleaner, renewable alternative to conventional fossil fuels. Such fuels, being compatible with current technologies or requiring minimal adaptations, represent the most actionable option for significant emissions reduction across these sectors, particularly short term. Influenced by regulatory policies and market trends, alternative fuels are poised to displace a significant portion of petroleum-based energy in transportation.

Alternative fuels can be categorized according to their feedstock. Biofuels, which are largely available today, are derived from organic matter. Synthetic fuels are synthesised utilising non-organic matter, often produced through electrical processes using green hydrogen. Currently, Ethanol and Biodiesel account for over 90% of the world’s alternative fuel production for transportation. The rest, about 10%, is composed by Renewable Diesel and Sustainable Aviation Fuel. Although Biodiesel (FAME) and Renewable Diesel (HVO) have similar names, they are distinctly different products. Biodiesel can degrade over time and cannot be used without blending, whereas Renewable Diesel can fully replace conventional diesel.

¹Biomethane is not considered because, as of today its main use is not transport, but rather heating and electricity, and petrolchem.

²Biodiesel is perishable and has reduced proprieties compared to Renewable diesel, that is comparable to fossil fuel diesel.

³Sustainable Aviation Fuel (SAF) can be produced in the same process as HVO, but facility have to be properly set-up.

“While biofuels are often promoted as sustainable alternatives, their production process sometimes tells a different story.”

While biofuels are usually promoted as sustainable as their name would suggest, their production process sometimes tells a different story. The bulk – c. 90% – of today’s biofuel production relies on agricultural crops whose sole function is to produce biofuels. These crops compete for land with food production and forests. In a scenario in which the U.S. meets its entire gasoline demand with ethanol, it is estimated that over 85% of the nation’s farmland would be converted into energy crop fields.

This drastic land use would not only be unsustainable, but could also threaten food security by diverting arable land from food to fuel production or trigger deforestation. Furthermore, the production of biofuels often doesn’t lead to a material net reduction in CO2 emissions compared to their fossil fuel counterparts, if not the opposite, as is the case for corn based ethanol in the US. This risk applies to a certain extent also to alternative fuels in general and, challenges the perception of all alternative fuels as being inherently sustainable. Good diligence is required to make sure there is no greenwashing.

Environmental solutions

For an alternative fuel to be deemed sustainable, it must use feedstock which does not lead to direct or indirect changes in land use, and which also significantly reduces greenhouse gas emissions compared to fossil fuel. The European Union defines such fuels as “Advanced Biofuels”, biofuels that are mainly produced using waste feedstock, or “Renewable Fuels of Non-Biological Origin”, synthetic fuels from green hydrogen.

Feedstock for advance biofuels can be categorized in three main categories:

- Waste Fat: Used cooking oil, animal fat byproducts, algae.

- Lignocellulosic Biomass: Agriculture or wood industry residues, lignocellulosic crops.

- Organic Waste: Sewage sludge, manure, other agriculture waste, organic municipal waste.

Each feedstock category follows a specific process to manufacture advanced biofuel and the same fuel can be produced using different feedstocks. For example, Sustainable Aviation Fuel (SAF) can be processed from lignocellulosic waste or waste fats, with the latter being currently cheaper and thus more scaled. The same SAF can also be produced from non-organic feedstock using green hydrogen.

“EU regulations will catalyse demand for sustainable advanced biofuels from waste feedstock.”

¹Co-processing is also possible, meaning blending renewable oils in traditional fossil fuel feedstock

²Waste Fat feedstock is limited, expected growth limitation for biofuel from this source (e.g. SAF)

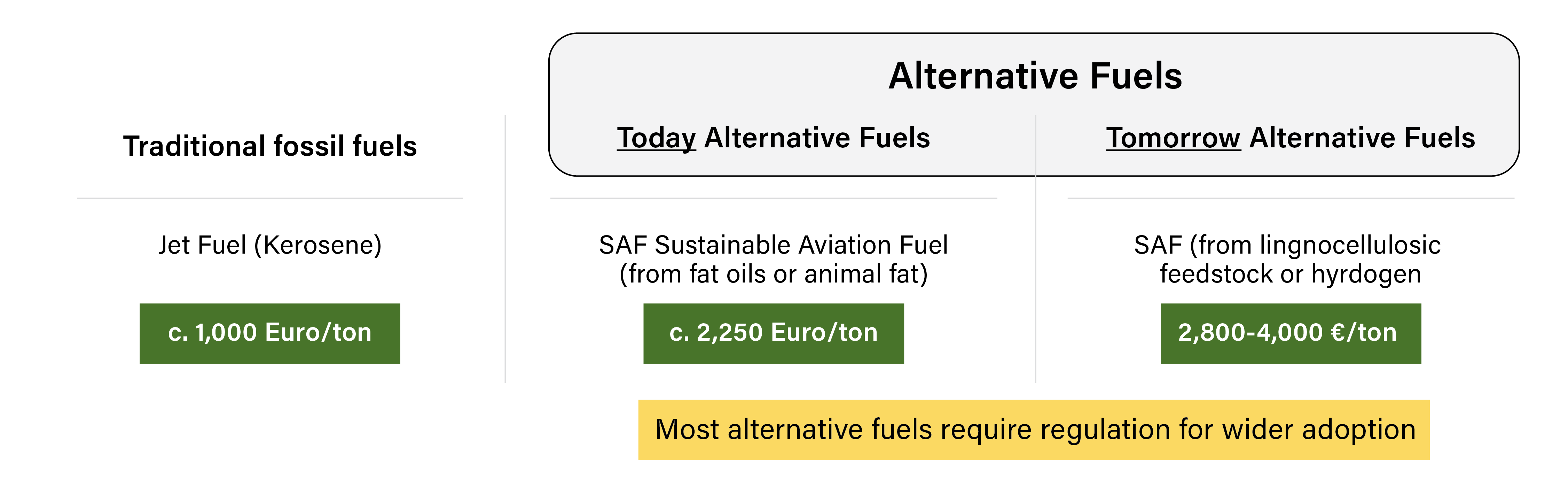

The primary barrier to adopting sustainable fuels in aviation and maritime sectors is their higher cost compared to traditional fossil fuels. Advance biofuels and hydrogen-based fuels are significantly more expensive. For example, while conventional jet fuel costs approximately 1,000 euros per ton, its sustainable version made from waste or animal fats is over double that price.

Future fuels, such as those from lignocellulosic feedstock or hydrogen, could be more than triple the cost of standard fuels today, largely due to limited production scale. Additionally, supply constraints pose a challenge. For instance, sourcing waste feedstocks like used cooking oil is not only costly but also faces limitations in global availability and annual growth rate.

Therefore other catalysts are driving the adoption of sustainable alternative fuels – regulatory policies and corporate decarbonization goals.

Regulatory policies are being developed in different countries, with the EU leading the effort. The Renewable Energy Directive III, FuelEU Maritime, RefuelEU Aviation Acts and the extension of the European Emissions Trading Scheme (ETS) to the aviation and maritime transport are all examples of policies aimed to foster a reliable demand for advanced biofuels and synthetic fuels, encouraging investment in their production with targeted policies.

These policies aim to stimulate investment through targeted measures, setting incremental targets for the use of advanced biofuels and imposing economic disincentives (such as penalties or additional carbon credit costs) on aviation and maritime companies that delay adopting sustainable fuels. The structure of these penalties is designed to make the use of sustainable alternative fuels more economically viable than facing penalties, despite the higher costs associated with alternative fuels. For example, penalties for aviation companies are calculated as twice the cost of the jet fuel price for the unutilized tons of SAF necessary for compliance. Additionally, using SAF can reduce the number of ETS credits required. Our analysis, based on average fuel prices of 2022, suggests that aviation companies would benefit more from using SAF than from paying penalties and extra ETS costs.

Other countries are also driving regulations in this direction, for instance US programs supporting the alternative fuel market development include the RIN (Renewable Identification Number) system, the blended tax rate and the LCFS (Low Carbon Fuel Standard).

Corporate decarbonization goals also significantly influence the adoption of sustainable fuels. For instance, by the end of 2022, companies committed to Science-Based Targets initiative (SBTi) represented 34% of the global public economy by market capitalization (up from 28% the previous year) totalling over $100 trillion. These companies set long- and short-term decarbonization objectives, encouraging the reduction of their carbon footprint. Given the wide-reaching effects of transportation across industries, there is dual pressure to cut emissions: transport companies aim to lower their direct (scope 1) emissions, while their customers are focused on reducing indirect (scope 3) emissions linked to transport services.

Sustainable biofuels are derived from feedstocks that don’t lead to direct or indirect changes in land use and that significantly reduce greenhouse gas emissions compared to fossil fuels alternatives.

Investment opportunities

Achieving Europe’s ambitious decarbonization goals requires comprehensive development of both supply and infrastructure for the production and distribution of alternative fuels. Both project-level initiatives and manufacturing sectors, including logistics services, play a crucial role in this transition.

On the feedstock side, companies which control the supply of critical feedstocks, such as companies involved in fat rendering or collection of used cooking oil, can increase their output and potentially increase their contracting power.

Furthermore, companies involved in the plant equipment or production of consumables, like membranes or catalysts, are also posed to benefit from this transition. In Europe, Sulzer and Clariant AG are exposed to these themes with a minor portion of their revenues.

Finally, companies involved in the production of advanced biofuels can benefit from economies of scale further development in the space. For instance, Borregard is the leader in advanced ethanol production using waste lignocellulosic fuel, while Neste and Darling Ingredients are highly active in the production of biofuels from waste oils. Recent market operations from financial players like Goldman Sachs investment in Verdalia (€3 bln), Bain Capital in EcoCeres (€400 mln) and Macquire in SkyNRG (€175 mln) highlight the interest in this market.

“Companies controlling the fat and waste oil supply can benefit as demand for this renewable feedstock grows.”

Important information

This material is of a promotional nature and is provided for information purposes only. Please note that this material may contain technical language. For this reason, they may not be suitable for readers without professional investment experience. This document is issued by Ambienta SGR S.p.A. It is not intended for solicitation or for an offer to buy or sell any financial instrument, distribution, publication, or use in any jurisdiction where such solicitation, offer, distribution, publication or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful to address such a document.

Nothing in this document constitutes legal, accounting or tax advice. The information and analysis contained herein are based on sources considered reliable. Ambienta SGR S.p.A uses its best effort to ensure the timeliness, accuracy, and comprehensiveness of the information contained in this marketing communication. Nevertheless, all information and opinions as well as calculations indicated herein may change without notice.

Ambienta SGR S.p.A. has not considered the suitability of this investment against your individual needs and risk tolerance. To ensure you understand whether our product is suitable, please read the Prospectus and relevant offering documents. Any decision to invest must be based solely on the information contained in the Prospectus and the offering documentation. We strongly recommend that you seek independent professional advice prior to investing.

Luca Zerba Pagella

Luca Zerba Pagella  Fabio Ranghino

Fabio Ranghino