Sustainable Agriculture

Challenges of the agrifood value chain

The agrifood system is constantly under pressure to satisfy increasing food demand. This is particularly driven by emerging markets – by 2050 90% of global population growth is expected to be driven by Africa and Asia. It is estimated that by 2050 we will face a ca. 20% food demand-supply gap if current population growth trends continue without a change in dietary habits.

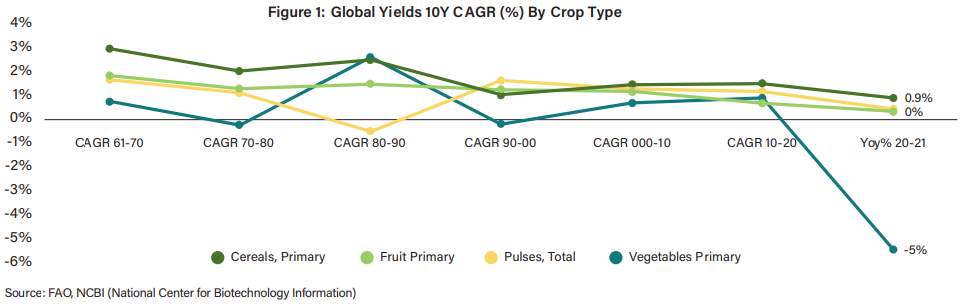

In addition, climate change effects such as increasing temperature, as well as disruptive climate events such as floods and droughts, have tremendous and unpredictable effects on agriculture yields and thus on food supply. Production of pulses in the USA for instance decreased by ca. 40% yoy in 2021 because of extreme heat (Figure 1).

“It is estimated that we will face a 20% food demand-supply gap by 2050.”

In the face of these pressures, productivity improvement is critical to tackle the biggest challenge for the industry, which is to meet the required food demand increase while limiting the environmental impact of the sector. The agrifood value chain is responsible for 26% of global GHG emissions, nearly 70% of freshwater withdrawal and nearly 40% of land use (2/3 of it used for meadow & pasture).

Historically, mainly 3 drivers have contributed to productivity gains (i) increasing the use of chemical inputs (fertilizers/pesticides) (ii) seed selection including the adoption of GMOs (iii) automating different phases of the production process.

However, each of these solutions has been associated with environmental consequences: (i) the heavy spread of chemicals on agriculture land has resulted in degraded soils, poor of nutritional substances, while certain weed species have developed resistance to herbicides, making their usage less effective in protecting crops health; (ii) significant GMO adoption has been linked to biodiversity loss and (iii) automation and mechanisation have increased farming related emissions.

Governments are trying to address these sustainability issues by posing limitations on the use of chemical inputs (fertilisers and pesticides) and imposing rotation with regenerative crops like legumes. In Europe, a dedicated “Farm to Fork” strategy has set certain targets for different environmental metrics like emissions and chemical use reduction.

However the extent of this transformation has generated opposition across industry participants, from incumbent players and farmer organizations which impaired full approval of the strategy. The fear of loss of productivity driven by these limitations, combined with the contemporary reduction of farming incentives (e.g. the cut of diesel fuel subsidies in Germany), along with the increasing import of commodities from countries with less stringent focus on environmental concerns, have led European farmers to protest in several countries. Ultimately, EU environmental targets for the sector, especially related to pesticide use, have been backtracked. In the lead-up to the EU Parliament elections set for June 2024, the regulatory review can’t be expected before next year, with implementation in 2026 at the earliest.

Despite these challenges, many opportunities can be found along the agrifood value chain, supported by long term environmental sustainability trends. Even if regulatory efforts are subject to a slowdown, consumers, and in turn food transformers and retailers, continue to push towards traceability and sustainability of food products, thereby creating profitability pools for those industry players which have stayed ahead of these market dynamics.

Investment opportunities along the value chain

The agrifood industry represents ca. 10% of global GDP – making up a $10tn market opportunity, in which solutions improving crop yields while reducing environmental risks represent investment opportunities.

Field inputs

The natural fertiliser and bioprotection market is growing at double digit rates (ca. 10-12% CAGR), with room for further growth. Despite the above-mentioned slowdown of chemical inputs regulation, agrifood players are willing to meet customer demand for healthy and sustainable products, setting farming rules for their suppliers, such as establishing threshold for residual pesticides. Further evidence of this trend are large industry players, traditionally exposed to chemical inputs, who are moving towards natural alternatives, mainly through M&A and partnerships: Corteva bought the Spanish Symborg, producer of biofertilisers, biostimulant and biocontrol products in 2022; Bayer on the other hand has chosen to develop a number of partnerships with R&D players and startups that develop biocontrol solutions, which could improve its growth prospects, given regulation and market uncertainty.

Testing, inspection and certification

Companies benefit from the increasing attention to traceability and transparency in the agrifood value chain, which translates to double digit market growth (ca. 10%). This segment benefits both from regulatory and market drivers. In Europe for instance, since 2022 all food and feed producers must identify the origins of their products according to the General Food Law, mainly for food safety purposes, as they facilitate product recall in case a product is found non-compliant with safety or quality standards, and encourage responsible consumption. Research¹ has demonstrated higher willingness to pay for products carrying zero or low residue pesticides certification labels.

Farming equipment

Precision agriculture technologies such as Variable Rate technologies, that apply the right amount of nutrition and protection inputs according to crop needs, are critical to unlock yield growth opportunities while limiting the environmental impact of farming practices. For instance, the “See & Spray” technology developed by Jhon Deere leverages real time data from cameras installed on the spraying booms with embedded computing capabilities to target only dangerous weeds, thus saving up to 60% on crop protection and related costs. Other large listed OEMs such as CNH and AGCO have invested in these technologies, with AGCO focusing mainly on providing retrofit solutions for the existing fleet, and CNH acquiring Raven Industries in 2021, specialized in spraying solutions.

“The agrifood industry represents ca. 10% of global GDP – making up a $10tn market opportunity”

¹Source: Frontiers 2022, Consumer preference and willingness to pay for low-residue vegetables; HAL OpenScience 2020, Estimation of consumers’ willingness to pay to reduce pesticides, based on experimental markets

Important information

This material is of a promotional nature and is provided for information purposes only. Please note that this material may contain technical language. For this reason,they may not be suitable for readers without professional investment experience. This document is issued by Ambienta SGR S.p.A. It is not intended for solicitation orfor an offer to buy or sell any financial instrument, distribution, publication, or use in any jurisdiction where such solicitation, offer, distribution, publication or use wouldbe unlawful, nor is it aimed at any person or entity to whom it would be unlawful to address such a document.

Nothing in this document constitutes legal, accounting or tax advice. The information and analysis contained herein are based on sources considered reliable. AmbientaSGR S.p.A uses its best effort to ensure the timeliness, accuracy, and comprehensiveness of the information contained in this marketing communication. Nevertheless, allinformation and opinions as well as calculations indicated herein may change without notice.

Ambienta SGR S.p.A. has not considered the suitability of this investment against your individual needs and risk tolerance. To ensure you understand whether our productis suitable, please read the Prospectus and relevant offering documents. Any decision to invest must be based solely on the information contained in the Prospectus andthe offering documentation. We strongly recommend that you seek independent professional advice prior to investing

Federica Mallone

Federica Mallone  Fabio Ranghino

Fabio Ranghino