End of Life of Construction Materials

Environmental problem

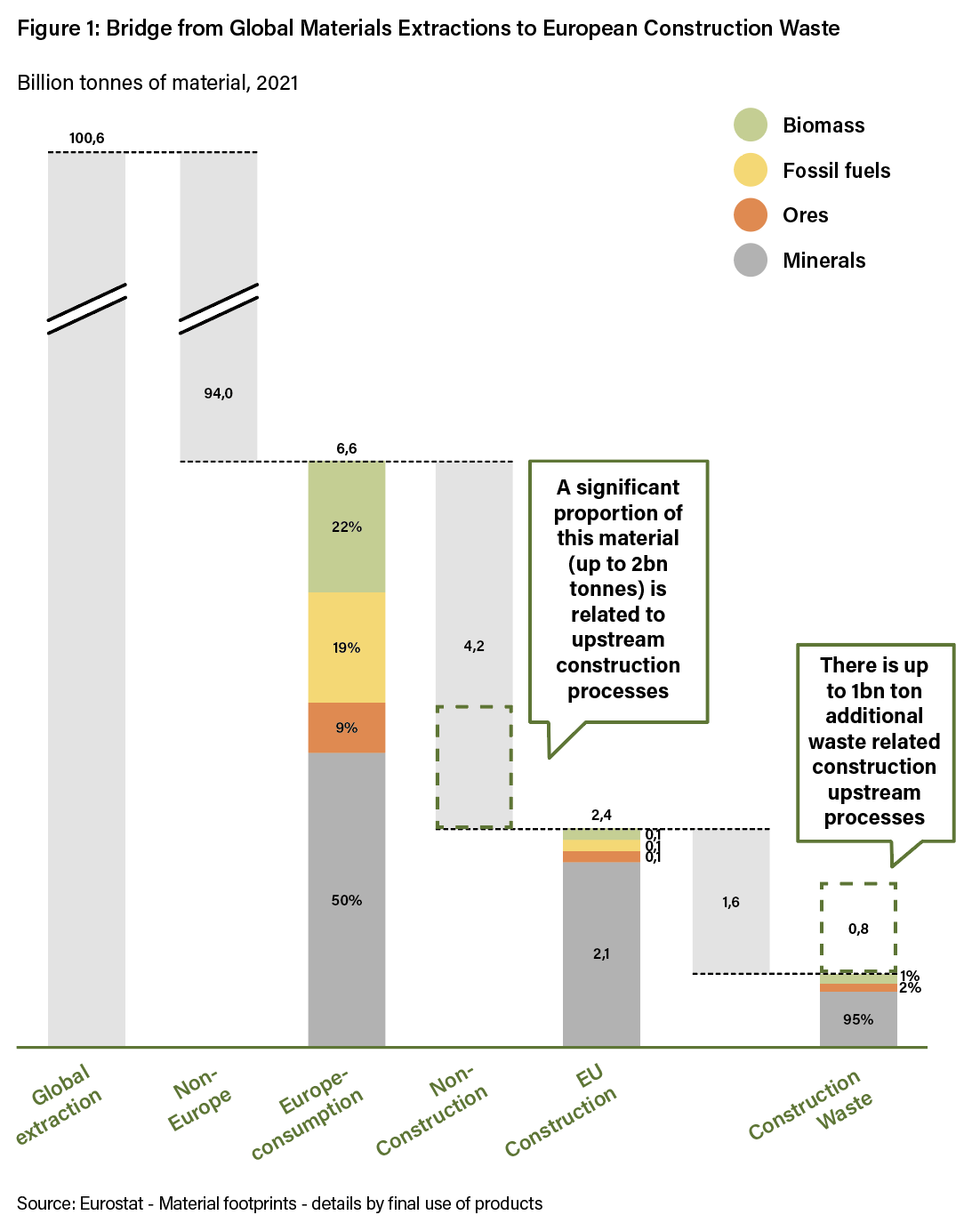

Every year the world extracts approximately 100 billion tonnes of materials – enough to build 17,000 Cheops pyramids or equivalent to approximately 10 tonnes per person on the planet. The primary driver for this vast demand is construction, accounting for around 50% of all resources extracted.

In terms of volume, most construction resources are non-metallic minerals, mainly used for concrete, stone, ceramics and glass. Nonetheless the construction industry is also the largest consumer of metal, using over 50% of the world’s steel in buildings and infrastructures. Similarly, it is the main end market for wood-based products, making it a significant user of biomass. Indirectly, the construction sector heavily relies on fossil fuels due to the energy-intensive processes involved in producing materials like cement and steel.

In terms of volume, most construction resources are non-metallic minerals, mainly used for concrete, stone, ceramics and glass. Nonetheless the construction industry is also the largest consumer of metal, using over 50% of the world’s steel in buildings and infrastructures. Similarly, it is the main end market for wood-based products, making it a significant user of biomass. Indirectly, the construction sector heavily relies on fossil fuels due to the energy-intensive processes involved in producing materials like cement and steel.

In addition to heavy resource consumption, the construction industry is also notoriously inefficient in waste management. This includes mineral waste from producing concrete aggregates, steel slag from primary steelmaking, and mixed demolition waste that is not properly separated and recycled. While official figures indicate the construction industry generates about 30% of global waste, estimates suggest this figure could be as high as 50% when considering upstream manufacturing processes and the fossil fuels used for raw material production¹.

“While official figures indicate the construction industry generates about 30% of global waste, estimates suggest this figure could be as high as 50% when considering upstream manufacturing processes.”

¹Eurostat and Ambienta analysis

Environmental Solutions

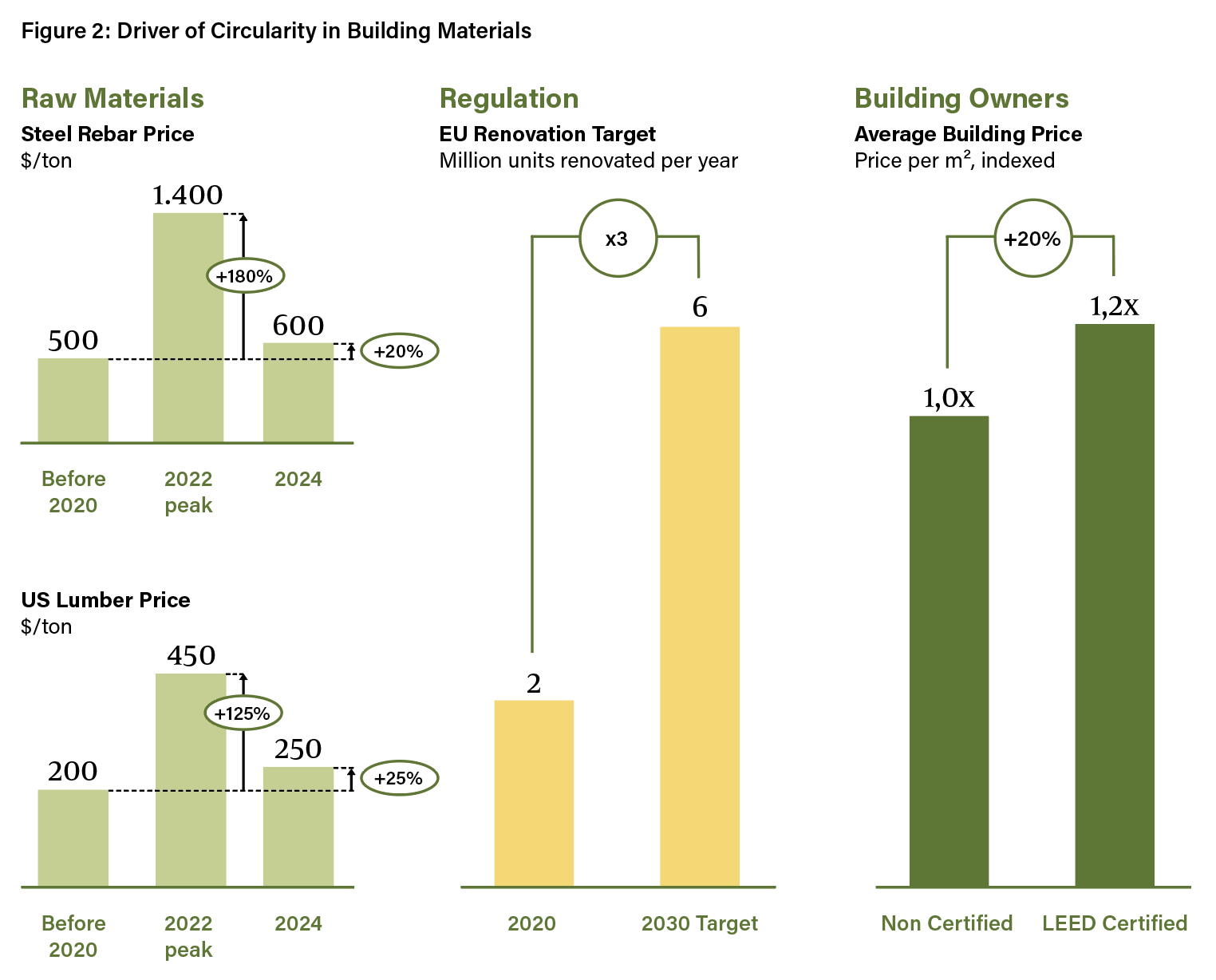

While the need for better management of construction materials is clear, we believe the time is ripe for circular business models in construction to thrive over the next decade and beyond. This shift is driven by three main factors: Figure 2: Driver of Circularity in Building Materials

- Volatility and Rising Costs of Raw Materials: In recent years, raw material prices have shown significant volatility and an overall increase. For example, steel and lumber prices have spiked by over 200% and currently remain more than 20% higher than the five-year average. Reusing waste materials or existing building stock has become a strategic value proposition to contain construction costs.

- Regulatory Push for Renovation and Waste Management: In the EU, there is a strong focus on renovating the building stock to meet Paris Agreement pledges. The renovation rate needs to increase from the current 1% of buildings renovated each year to an estimated 3% to achieve these goals. As a result, a significant increase in construction and demolition (C&D) waste will be generated. In parallel, regulatory measures, such as the Waste Framework Directive and the Construction Product Regulation, are pushing for the industry to adopt a “zero landfill” approach, by raising the cost of disposal, and to increase the share of recycled content in construction materials. The combination of these two phenomena support the development of circular business models.

- Growing Environmental Consciousness: Environmental awareness is rising among building owners, both private and corporates. Lower running costs of high energy efficiency buildings and regulator push for higher environmental standard in the built environment support higher long term valuations. On average, certified sustainable buildings, such as those with LEED certification, have a 20% higher value per square meter, better occupancy rates, and higher resale value.

“Certified sustainable buildings have a 20% higher value per square meter.”

Investment opportunities

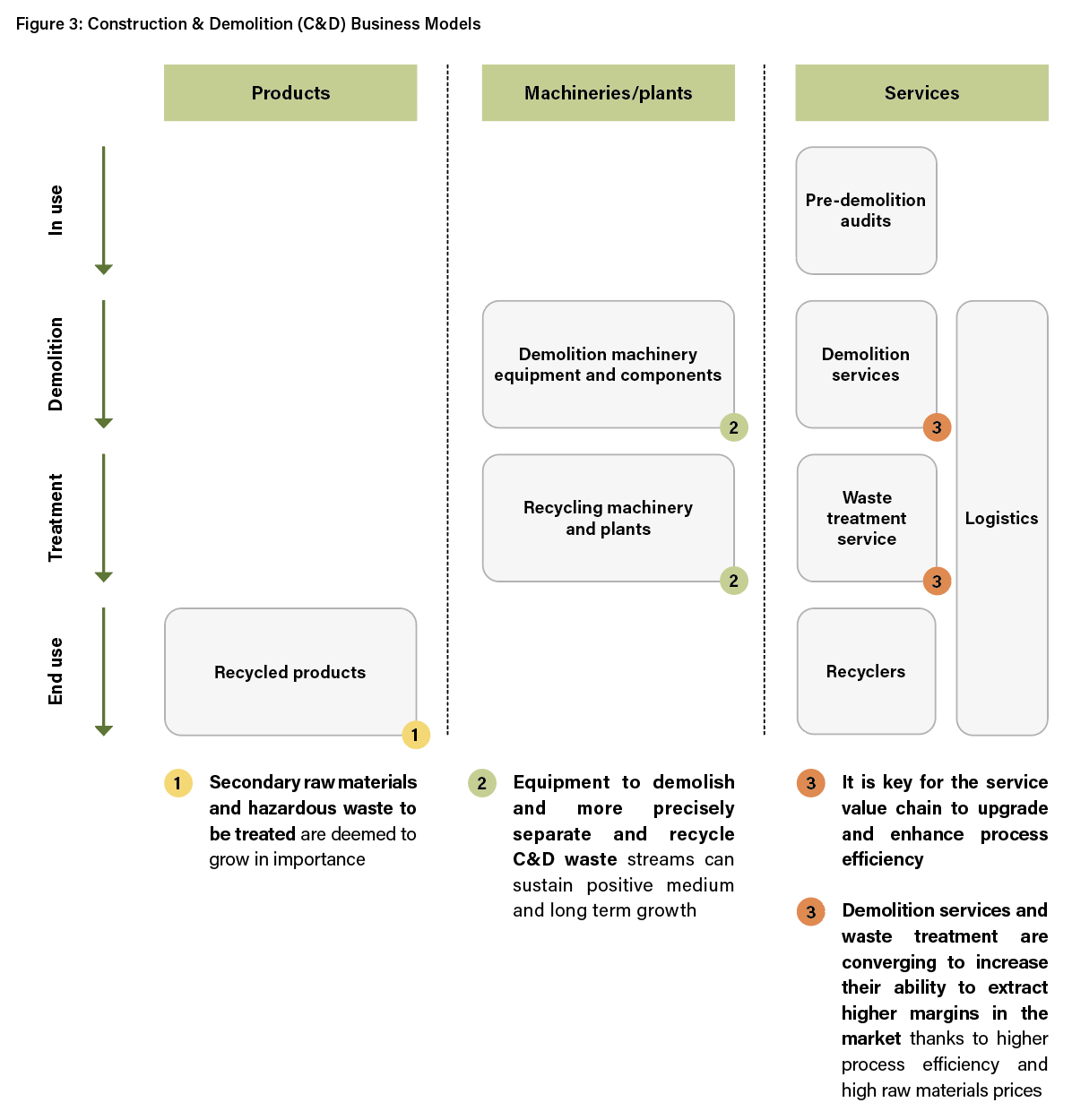

Circularity can be improved across the entire $10 trillion construction value chain, from design and raw materials production to construction, building use, and end-of-life management. Here are some of the most promising business models we consider worth exploring for investments in this environmental trend:

- Recycled products content in cement and other raw materials. Incorporating recycled products in cement and other raw materials can significantly lower their carbon footprint. In the cement industry, clinker replacement with secondary raw materials is crucial to lower the sector’s carbon footprint. Holcim, Europe’s leading cement producer, claims to achieve a 5% price premium for its low emission cement line, ECOPlanet, and aims for a 20-35% premium with its fully decarbonized products, the ECOPlanet Zero line. In parallel, Holcim is laying the ground to increase its capacity to treat construction and demolition (C&D) waste in order to secure its supply of secondary raw materials. The company targets to process 20 million tonnes of waste by 2030, which would represent a sizeable 7% of all C&D mineral waste produced in Europe each year.

- C&D machinery market. The construction and demolition machinery market includes machinery for demolition, shredding, crushing, sorting, screening, and handling construction waste. This market has experienced a significant growth over the past 5 years, outperforming the overall construction market and the construction machinery market. Our internal estimates suggest a CAGR above 10% since 2019. Those machines represent a much-needed capex to meet decarbonization targets over the next decade.

- Industrial decommissioning services. Aqequate decommissioning of industrial sites and treating hazardous materials is crucial and it can present a very profitable model. Companies that can dismantle sites and recover secondary raw materials (such as steel, aluminium, and copper) can turn liabilities (industrial hazardous waste) into resources, significantly reducing landfill disposal costs. Best-in-class companies in this sector have in-house recovery and separation facilities and can generate revenue from both decommissioning contracts and the sale of secondary raw materials. With increasing landfill costs and structurally higher secondary raw material prices, decommissioning service businesses are poised for an increase in margins over the next decade.

“With increasing landfill costs and structurally higher secondary raw material prices, decommissioning service businesses are poised for higher margins over the next decade.”

Important information

This material is of a promotional nature and is provided for information purposes only. Please note that this material may contain technical language. For this reason, they may not be suitable for readers without professional investment experience. This document is issued by Ambienta SGR S.p.A. It is not intended for solicitation or for an offer to buy or sell any financial instrument, distribution, publication, or use in any jurisdiction where such solicitation, offer, distribution, publication or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful to address such a document.

Nothing in this document constitutes legal, accounting or tax advice. The information and analysis contained herein are based on sources considered reliable. Ambienta SGR S.p.A uses its best effort to ensure the timeliness, accuracy, and comprehensiveness of the information contained in this marketing communication. Nevertheless, all information and opinions as well as calculations indicated herein may change without notice.

Ambienta SGR S.p.A. has not considered the suitability of this investment against your individual needs and risk tolerance. To ensure you understand whether our product is suitable, please read the Prospectus and relevant offering documents. Any decision to invest must be based solely on the information contained in the Prospectus and the offering documentation. We strongly recommend that you seek independent professional advice prior to investing.

Guido Fucci

Guido Fucci  Fabio Ranghino

Fabio Ranghino